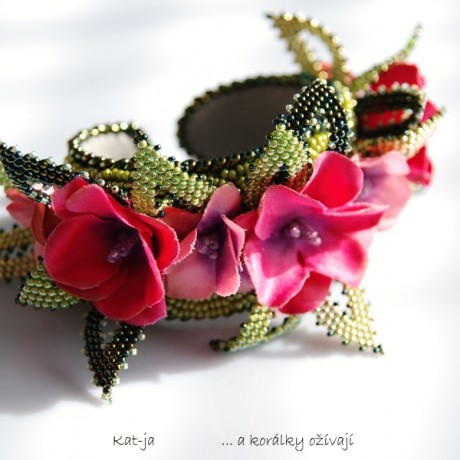

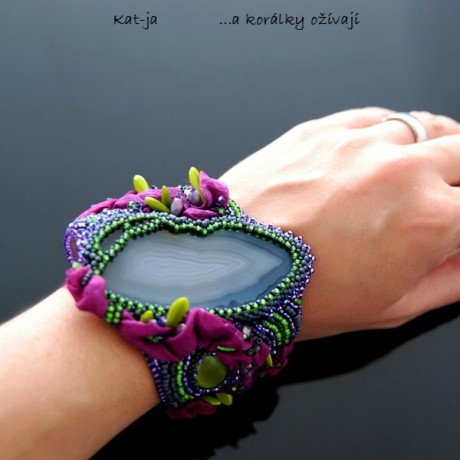

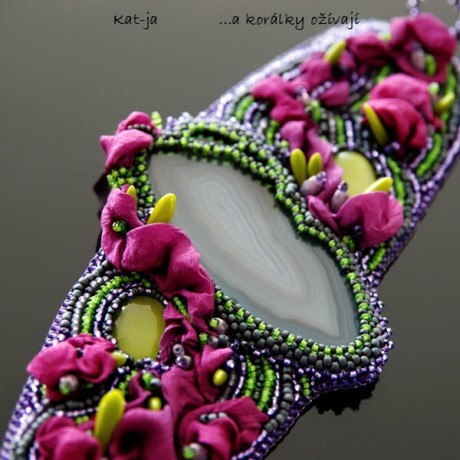

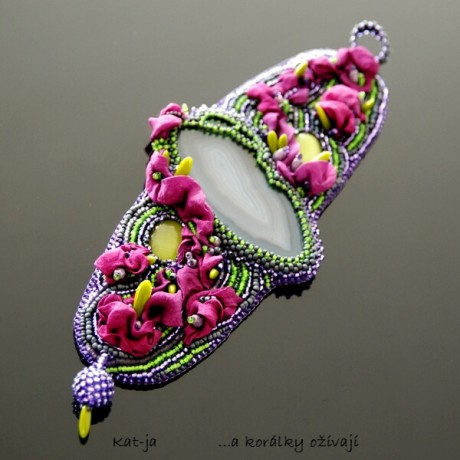

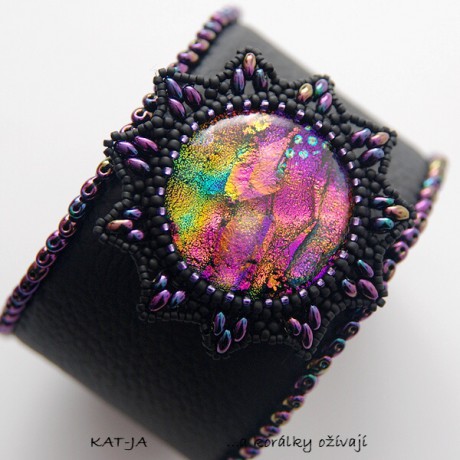

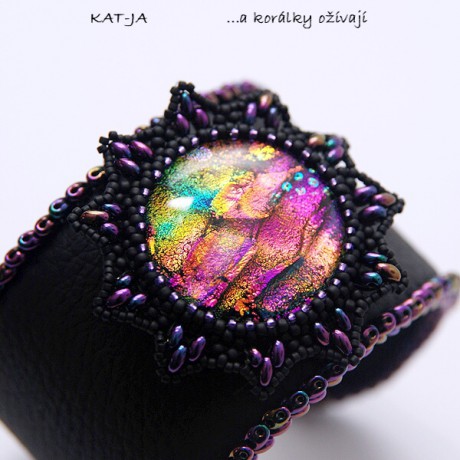

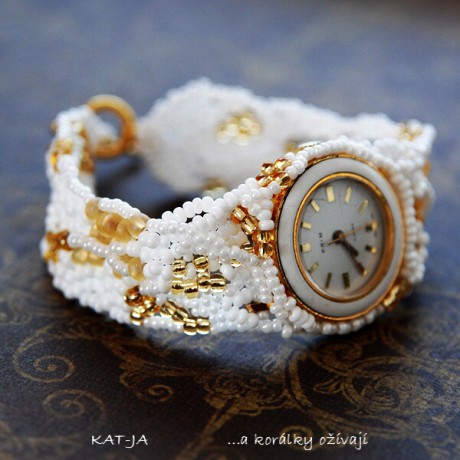

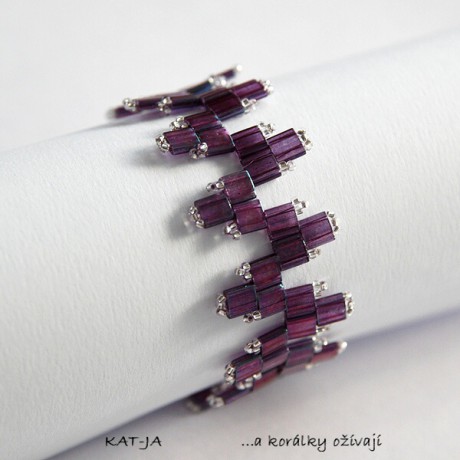

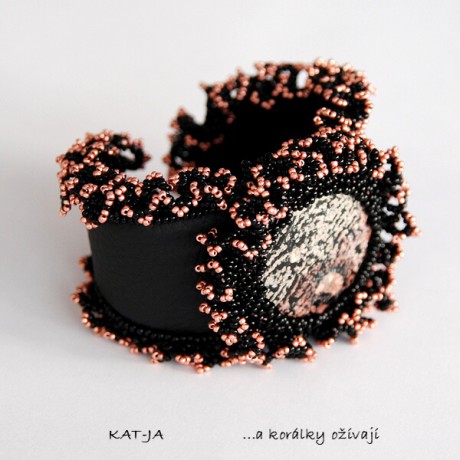

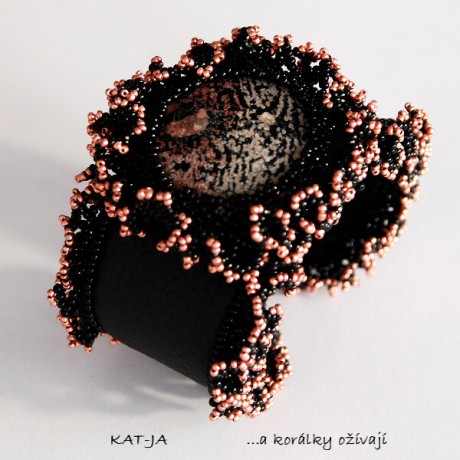

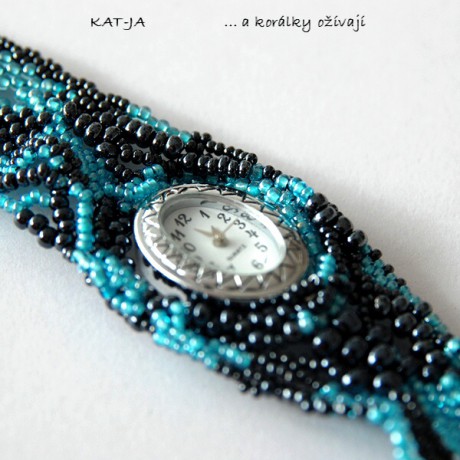

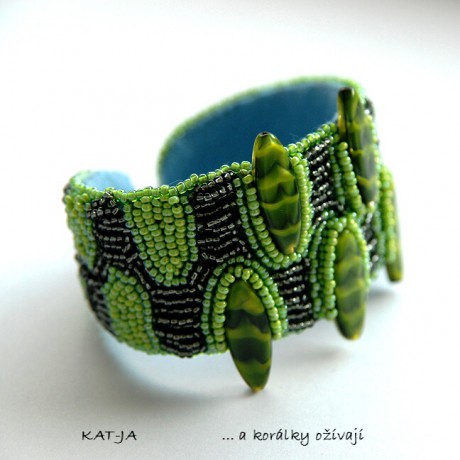

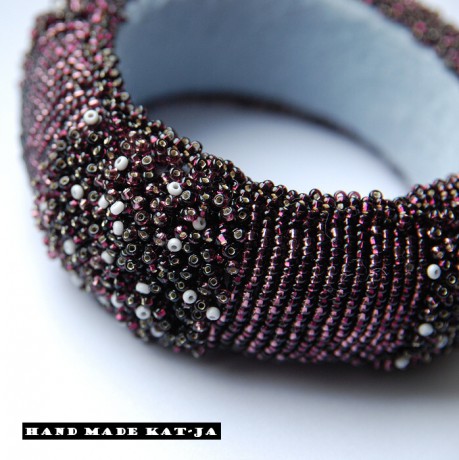

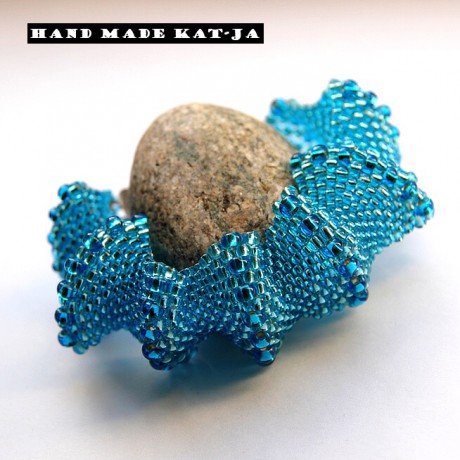

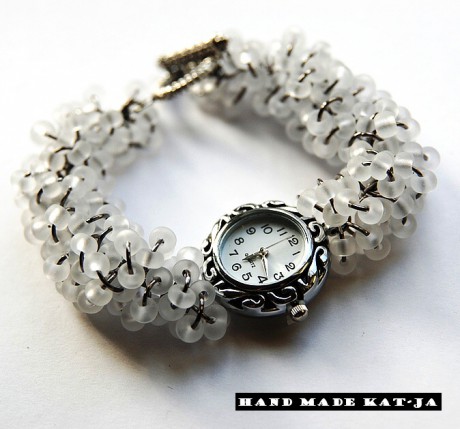

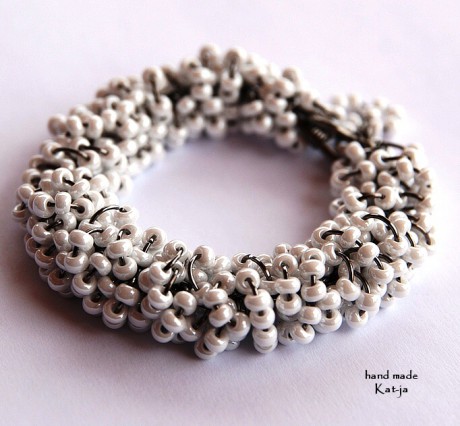

Náramky

Komentáře

Přehled komentářů

smartblip home gadgets https://smartblip.com best price

Anthonyfef - semlava

https://semlava.com/

DerrickyClirl - Где Купить Кокаин в Киеве? САЙТ - KOKS.TOP Как Купить Кокаин в Киеве САЙТ - KOKS.TOP

Купить Кокаин в Киеве? Цена на Кокаин САЙТ - https://koks.top/

.

.

Доставка В руки Кокаин в Киеве - https://koks.top/

Закладки с гарантией в Киеве - https://koks.top/

Чистый Кокаин в Киеве САЙТ - https://koks.top/

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Теги - Купить Кокаин в Киеве?

Кокаин в Киеве Доставка в руки?

Закладки Кокаин в Киеве?

Где Купить Кокаин в Киеве?

Лучший Кокаин в Киеве заказать Кокаин круглосуточно?

Кокаин Украина

EdgareitAlter - Как в Киеве Купить Мефедрон? САЙТ - KOKS.TOP Кристаллы Мефедрон Киев? САЙТ - KOKS.TOP

Качественный Мефедрон в Кристаллах

Купить Мефедрон в Киеве - https://koks.top

Доставка по городам Мефедрон Кристаллах - https://koks.top

Доставка в руки написать адрес САЙТ - https://koks.top

Купить Мефедрон в Кристаллах - https://koks.top

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Теги - Купить Мефедрон в Киеве?

Чистый Мефедрон Кристаллы в Киеве?

Как Купить Мефедрон закладкой в Киеве?

Доставка Мефедрона по Киеву

Мефедрон Украина Кристалл

PeterRom - fuckingcouple

https://fuckingcouple.com

CharlessaF - pornkingcams webcams

https://pornkingcams.com/

VlasofKristinamrPr - seo интернет accommodation online www Dr nonna

https://Dr-Nona.ru/ - Dr Nonna

Robertkeept - livevideochat-xyz

https://www.livevideochat.xyz/

CharlessaF - pornkingcams webcams

https://pornkingcams.com/

IsmaelNup - OLaneKer

Hi, after reading this amazing article i am too happy to share my experience here with friends.

https://antivirusreviewsoft.com/best-antivirus-software-of-2024-comprehensive-guide-and-recommendations Best Antivirus Software of 2024: Comprehensive Guide and Recommendations

Ronaldshive - livecams-video private

https://livecamsporno.com/

Willielig - e-porn.net

<b>https://e-porn.net</b> free xxx tube videos webcams dating,

онлайн камеры, знакомства

MichaelCom - Saloon into the область of high-efficiency

https://antimafia.se/ - hashish with a syringe 5 grams sleva. 18%

https://antimafia.se/ - powdered heroin - snorting 30 grams sleva 12%

https://antimafia.se/ - ecstasy under the tongue - 3 gram sale 13%

https://antimafia.se/ - hachis con una jeringuilla 51 gramas sleva. 13%

https://antimafia.se/ - heroina en polvo - esnifada 100 grama sleva 21%

https://antimafia.se/ - extasis bajo la lengua - 2 grama descuentos 25%

https://antimafia.se/ - hasista ruiskulla 7 grams sale. 36%

https://antimafia.se/ - heroiinijauhe - nuuskaaminen 30 gram sale 46%

https://antimafia.se/ - ekstaasi kielen alla - 1 gram discount 16%

https://antimafia.se/ - haszysz za pomoca strzykawki 17 gramy discounts. 21%

https://antimafia.se/ - sproszkowana heroina - wciaganie 70 gramy sleva 47%

https://antimafia.se/ - ekstaza pod jezykiem - 16 gramy sale 14%

https://antimafia.se/ - du haschisch avec une seringue 10 grammes sale. 21%

https://antimafia.se/ - heroine en poudre - sniffer 100 grammes discounts 15%

https://antimafia.se/ - ecstasy sous la langue - 15 gram sleva 45%

DanielBully - Стройка и ремонт

Если вы решили самостоятельно заняться строительными и ремонтными работами, советуем Вам посетить наш сайт https://техноуспех.рф. Вы узнаете, как правильно подобрать инструмент и спецодежду, кабель для замены электропроводки, построить здание из пеноблока, сделать кухонный фасад, заменить кран, украсить окно витражом, восстановить старую мебель, отремонтировать кабельные линии, выбрать и утеплить окна, увеличить пространство с помощью света и многих других полезных советов.

Fobertkat - ShaneKer

I used to be able to find good information from your articles.

www.sitebs.ru/blogs/95000.html

www.riso.ch/pages/alimentation/recettes-riz/?oid=1985&lang=fr&seite=1&action=recipe&recipeId=152

buldingnews.ru/page/3

www.es-presto.ru/community/groups/0-0/56-za-skol-ko-vozmozhno-kupit-diplom-universiteta-v-nashe-vremya

ipoboard.ru/index.html#!/IPOboard

Cyharlesrok - Exploring the Magic of Dating: Connections, Growth, and Idea

Dating is a go abroad that encompasses the enchanting of good samaritan coherence, offensive increase, and overpowering discoveries. It is a process to which individuals explore romantic possibilities, getting to know each other on a deeper level. Dating allows people to allowance experiences, market ideas, and father consequential connections.

https://gayblowjob.tv

In the duchy of dating, a person encounters a dissimilar kind of emotions. There's the exhilaration of convention someone contemporary, the foreknowledge of a first escort, and the thrill of discovering stock interests and shared values. It is a stretch of vulnerability and self-discovery as individuals public themselves up to the plausibility of inclination and companionship.

https://twinkporn.one

Effectual communication lies at the will of dating, facilitating accord and consistency between two people. It involves acting listening, ethical language, and empathy, creating a room for trustworthy dialogue. Including communication, individuals can tour their compatibility, the board thoughts and dreams, and raise a foundation of trust.

Jameswrarm - Привет, МИР! — чтобы быть всегда в плюсе.

Оформите страхование выезжающих за рубеж онлайн и путешествуйте с уверенностью. Полис ВЗР от Привет, МИР! обеспечивает медицинское покрытие, помощь в экстренных случаях и защиту багажа. Защитите себя от непредвиденных расходов и наслаждайтесь каждой минутой вашего путешествия. https://privetmir.com/strakhovanie-vyezzhayushhikh-za-rubezh

KimGew - airport parking j22c

Похожее есть что-нибудь?

For {parking|#file_links<>C:\Users\Admin\Desktop\file\gsa+en+100kvangelder170624URLBB.txt",1,N], the {same|same} tariffs apply as {also|and} for {parking|parking} parking spaces at {airport|terminal|airfield}. you {can|have the opportunity} {to change|change} your reservation {couple|2} hours before {arrival|arrival}.

IsmaelNup - ShaneKer

Hi there, its fastidious paragraph regarding media print, we all be familiar with media is a wonderful source of information.

ifvex.com/blogs/2501/Why-is-the-popularity-of-higher-education-decreasing-in-our

www.antiviruses.ru/about_antivirus/drwebdos.html

www.pigcraft.ugu.pl/printthread.php?tid=101709

varikoznic.ru/varikoz/obsledovanie?filter_by=featured

www.livesportonline.org/football-news/news-details/Arsenal-handle-Dundalk-in-Europa-League-group-stage-win/35346/2/

EdgareitAlter - Как в Киеве Купить Мефедрон? САЙТ - KOKS.TOP Кристаллы Мефедрон Киев? САЙТ - KOKS.TOP

Качественный Мефедрон в Кристаллах

Купить Мефедрон в Киеве - https://koks.top

Доставка по городам Мефедрон Кристаллах - https://koks.top

Доставка в руки написать адрес САЙТ - https://koks.top

Купить Мефедрон в Кристаллах - https://koks.top

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Теги - Купить Мефедрон в Киеве?

Чистый Мефедрон Кристаллы в Киеве?

Как Купить Мефедрон закладкой в Киеве?

Доставка Мефедрона по Киеву

Мефедрон Украина Кристалл

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 244 245 246 247 248 249 250

MarcusCet - smartblip